Certified Healthcare Financial Professional

It assists that lots of finance certifications may bring campaigns and pay increases. But keep in mind that education is a good investment. Before you decide to join a certification program, remember that it may need a consignment of not merely time but cash. To get more bang for your buck, you'll want to figure out what instruction may help advance your expert objectives.

It assists that lots of finance certifications may bring campaigns and pay increases. But keep in mind that education is a good investment. Before you decide to join a certification program, remember that it may need a consignment of not merely time but cash. To get more bang for your buck, you'll want to figure out what instruction may help advance your expert objectives.

Below you’ll discover a dysfunction of five leading finance certifications and exactly how they may be able affect your job:

Three 'classic' economic certifications

1. Licensed Public Accountant (CPA)

The CPA has long been probably one of the most desirable certifications to employers in finance and accounting. It symbolizes trust, as well as the professional dedication to keep your skills and understanding of accounting, because credential needs recertification.

Cost: the fee can vary from state to mention, but exam and application costs for first-timers usually run-around $1, 000.

Demands: Again, this differs by area, but the majority says need a bachelor's level and several semester hours in both bookkeeping and business-related subjects before you remain for CPA exam. Also, one or two several years of knowledge working in direction of an authorized CPA are usually required.

Wish find out everything you need to know about the CPA — and some?

2. Master of Business Management (MBA)

While not theoretically a certification, the most recent Salary Guide from Robert Half notes that MBA is one of the most in-demand credentials in the finance field. If you are employed in a senior-level finance or analytical part — or desire to some day — you’ll need an MBA to secure the position. Pair it with a CPA to become a financial force is reckoned with, as it demonstrates to you have an excellent accounting background, business acumen and leadership skills.

Price: As a college graduate level, an MBA is pricey, and expenses is determined by the establishment you attend. Before you decide to have the ball rolling, it is really worth it to inquire of in case the employer offers a tuition-matching system.

Requirements: To enter an university graduate system, you’ll need a bachelor’s degree and large ratings regarding the GMAT or GRE. Seek advice from the college you’re enthusiastic about for specific requirements.

3. Project Management Expert (PMP)

PMP certification is a wonderful method to illustrate that you can handle a group and lead jobs — therefore’s a certificate very looked for in finance, according to the Salary Guide. Acquiring a PMP also shows businesses you’ve got the relevant skills to see a project through all stages, from preparation and implementation, to a successful closing. If you’re considering the part of inner auditor, controller or danger manager, keeping this certification could help improve you up the ladder.

Price: the last cost will depend on your membership condition in Project Management Institute (PMI) and whether you take a report or computerized exam. But you should intend on investing between $250 to $600.

Requirements: Test-takers holding a bachelor’s degree must have about three-years of expertise handling jobs and 35 hours of project management training. Those without a bachelor’s will require at least 5 years of experience and 35 hours of training.

Two niche certifications

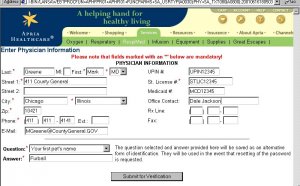

4. Licensed Medical Financial Expert (CHFP)

Financial talent with healthcare expertise is within popular, especially with all the difficulties the industry is encountering in the wake of the Affordable Care Act. The CHFP gives you qualified monetary training certain to healthcare. In the end, this will end up in increased possibilities for offers and raises.

Cost: Certification costs $395, but that doesn’t consist of the recommended study guides. You’ll like to budget another $250 to $300 for those.

Demands: To take the test, you should be an associate associated with medical Financial Management Association (HFMA). Pupil memberships don’t matter. It’s also strongly recommended you've got 3 to 5 years of experience with doctor management.

5. Energy Danger Pro (ERP)

With increasing international need for power additionally the associated conformity and danger facets, monetary expertise in the power field is hot. ERP official certification can drive your market price by showing companies that you possess knowledge to predict, recognize and manage the monetary dangers experienced when working in this specific business.

Price: the expense of exam and registration fees will be different based on once you subscribe. Early registration works about $750, while those registering later can get to pay $1, 050.

Requirements: there are not any education or knowledge requirements to sit when it comes to exam. But after driving, you've got five years to show couple of years of ERP-related work experience before you come to be qualified. As soon as certified, ERPs must just take 40 hours of continuing knowledge every couple of years.

Share this Post

Related posts

How to maintain health during times of stress?

A modern person experiences the same stress on weekdays as on a dark street. As a result, the nervous system is depleted…

Read MoreHow to Choose Healthcare Products

How to Choose Healthcare Products When it comes to health issues, quality of products we use is very important. There are…

Read More